Family Office Client Portals: 5 Vital Financial Insights + Examples

Jul 28, 2022

What to Look for When Selecting Client Portal Technology for Your Family Office

Client portals have taken many shapes throughout the years. With nearly every modern financial institution offering clients some form of digital access to their financial information, online portal technology is a far cry from its infancy.

The same can be said for family office client portals.

To paint the picture, let's take a look at the evolution of the Archway PlatformSM and its portal technology.

Originally introduced in the early 2000s, our initial portal concept was referred to simply as Investor Login. Limited to a handful of configuration options, the Archway Platform's Investor Login served as an online access point for individual users to view performance returns, capital activity, fees, and a select number of reports.

Since those early days, we have rolled out several iterations of the portal using a combination of client requests, internal feedback, and a healthy dose of innovative thinking.

[Find out Why Your Fintech Provider's Approach to Product Development is Important]

Which brings us to today, where the Archway Client Portal gives end-clients on-demand access to an interactive, mobile financial reporting tool.

Based on our experience developing and enhancing our own family office software and client portal, here are several key financial insights you should consider looking for when selecting client portal technology for your family office or financial institution.

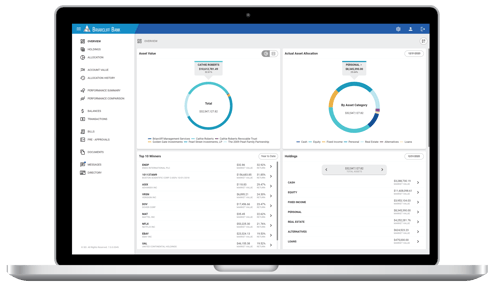

1. Consolidated net worth

This seemingly simple request can actually be one of the most difficult to questions to answer, especially when it comes to high-net-worth (HNW) individuals.

Your family office’s client portal should be able to—at a minimum—tell your end-client exactly how much they are worth, inclusive of cash, investments, property, and indirect exposure to additional holdings, at the click of a button.

We recommend looking for family office portal technology that can:

- Consolidate net worth across entities, portfolios, and assets

- Compute net worth based on direct and indirect holdings

- Show net worth changes over time based on investment performance, purchases, sales, contributions, withdrawals, accruals, and other types of activity

Archway Client Portal: Financial Overview Dashboard

Archway Client Portal: Financial Overview Dashboard

2. Aggregated holdings

Having the means to answer the question “How much am I worth?” is powerful, but being able to show the assets that make up your client’s net worth can have an even greater appeal.

A standard family office client portal should allow your end-clients to view individual holdings. An elite family office client portal should allow your end-clients to consolidate, group, filter, and categorize their holdings in ways that are meaningful to their understanding.

We recommend looking for family office portal technology that can:

- Aggregate holdings data across all types of assets such as equities, bonds, cash, real estate, personal assets, and alternative investments like private equity, hedge funds, and cryptocurrency

- Assess changes in market values over time

- Maintain user-defined asset categories or groupings

.png?width=400&name=Holdings%20with%20Detail%20+%20Dashboard%20(BCII).png) Archway Client Portal: Asset Allocation and Holdings Detail

Archway Client Portal: Asset Allocation and Holdings Detail

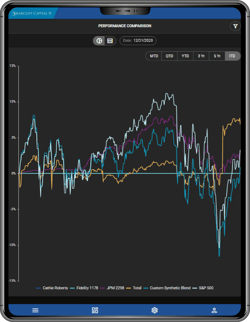

3. Investment performance

Being able to analyze investment performance falls into family office reporting 101—and serves as a key capability of any financial reporting tool. But to really hit the mark, a family office client portal should feature the ability to attribute performance to factors like asset type, portfolio manager, strategy, or region.

We recommend looking for family office portal technology that can:

- Render performance data in both graphic and tabular formats

- Compare performance against benchmarks

- Measure performance over time, across multiple periods

- Use multiple performance calculations such as time-weighted and money-weighted returns

Archway Client Portal: Performance Comparison with Benchmarks

Archway Client Portal: Performance Comparison with Benchmarks

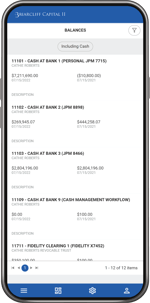

4. Cash balances

Understanding how much cash is available at any point in time is vital to a client’s financial health, particularly amongst individuals that have high transaction volumes or large purchase amounts.

Even for clients whose bills are paid by family office staff or an outsourced bill payment service, it’s always helpful to know how much money is available for day-to-day expenses.

We recommend looking for family office portal technology that can:

- Pull in daily cash activity from banks, custodians, and brokerage firms

- Provide on-demand cash balances as of a point in time

- Display cash flows and changes in cash balances over time

Archway Client Portal: Cash Balances

Archway Client Portal: Cash Balances

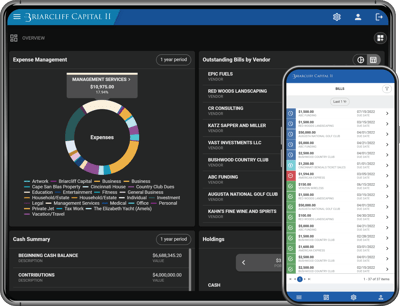

5. Expense and spending detail

Speaking of expenses, it can be easy for a family office or HNW advisor to focus their client portal search on tools that primarily show investment-related detail. But there can be tremendous value in being able to share accounting and investment data within a single portal.

By selecting a tool that can summarize expenses, identify spending habits, and even compare outflow detail against budgets and cash inflows, end-clients are able to be more in control of their recurring cash flow.

We recommend looking for family office portal technology that can:

- Categorize expenses based on user-defined expense categories

- Display summary-level expense data as well as underlying detail such as vendors, payment terms, and invoices

Archway Client Portal: Expenses and Bills Dashboards

Archway Client Portal: Expenses and Bills Dashboards

Beyond financial analytics and insights, we recommend assessing for other features as well, including things like bill payment approval functionality, document management, and customizable reporting dashboards.

To find tips, tricks, and best practices for adopting a client portal in your family office, check out Best Practices to Transition Your Family Office into the Age of Digital Reporting.

A family office client portal featuring valuable financial insights can introduce a new approach to traditional family office reporting.

Better yet, when offered as an interactive, user-controlled reporting experience, family offices can engage end-clients in ways that far surpass anything paper reports provide to create contemporary, meaningful connections with current and future wealth owners.

But if you’re still debating the merits of a client portal for your family office, start by checking out the Archway Client Portal’s flexible reporting dashboards, comprehensive financial insights, and easy-to-use tools. Operating as a seamless extension of the Archway Platform, our client portal can serve as the link you need between your family office staff and the family members they serve.

|

|

Chris Rose

|

Author

Chris Rose

Sales Director

Archway Family Office Services

Most Popular Posts

May 24, 2022

6 Ways to Build a Net Worth Report for Your Family Office Clients

Eric Sampson

How Family Offices Can Prepare a Holistic View of High-Net-Worth Client Wealth

May 17, 2019

Financial Reporting for the Modern Family Office

Steven Edelman

10 Types of Reports Every Family Office and Financial Institution Should Have in Their Toolkit

Apr 20, 2022

What Types of Software Do Family Offices Use?

Archway Family Office Services