What Is Outsourced Personal Expense Management and Why Is It So Important for Your Clients?

Mar 30, 2021

Learn How an Enhanced Bill Pay Service Can Help You Create a Better Client Experience

Over the years, the term family office has come to represent a variety of organizations. The traditional line of thinking equates to a single family office (SFO), where one high-net-worth, often multi-generational, family carries the overhead costs of a dedicated accounting, investment and operations staff.

However, more recently, the term has expanded to include multi-family offices (MFO) working with unrelated families and high-net-worth divisions of private banks that cater to the needs of wealthy families.

Regardless of how you define a family office, these firms tend to provide a core suite of services that may include:

- Investment strategy and measurement

- Management and client reporting

- General bookkeeping

- Specialized accounting including partnership and trust accounting

- Tax preparation

- Personal expense management

While any of these services can be outsourced, we commonly see family offices seeking third-party support of one service in particular: personal expense management.

So, what is personal expense management?

Personal expense management traditionally encapsulates bill payment, bank account reconciliation, credit card analysis, vendor management and expense and cash flow reporting.

At this point, you might be wondering what the difference is between personal expense management and more commonly advertised bill payment services?

In general, personal expense management is a more comprehensive set of services that includes enhanced versions of traditional bill payment services alongside white glove concierge services and enriched financial reporting.

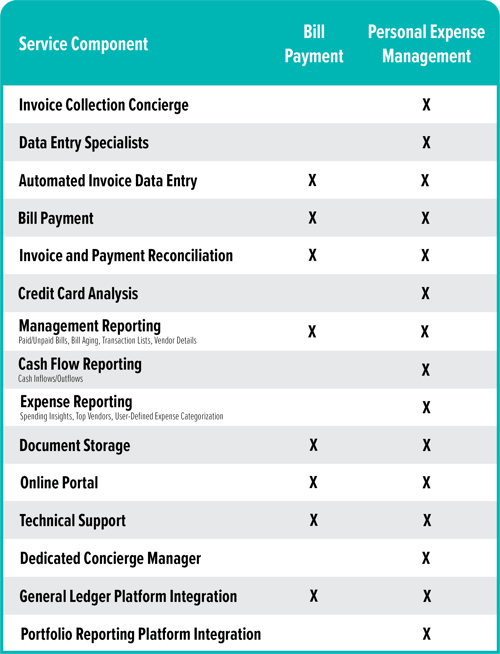

Compared against each other, personal expense management versus bill payment services may look something like this:

Lastly, why do family offices seek to outsource this particular function?

For most, it’s a matter of capacity.

Personal expense management is a time-consuming set of operations, especially for family offices serving multiple generations and/or clients. Adding more households increases complexity and, subsequently, the amount of time spent paying bills, reconciling transactions and compiling reports.

Further compounding the situation, some family offices don’t have dedicated accounts payable staff. As a result, the workload is spread across the team or performed by accountants that could be completing more value-added tasks.

To help keep staff focused on nurturing client relationships and growing their business, these firms look to partner with a trusted service organization like Archway Family Office Services, where a dedicated team of operations and accounting professionals are able to absorb the operational intricacies of the family office’s bill payment and expense reporting processes.

From a business perspective, the added benefits of partnering with a service organization are abundant.

[Check out these Five Reasons to Use an Outsourced Bill Pay Service to find out how personal expense management can add value to your overall service offering.]

But what about your end-clients? How does an outsourced personal expense management service add value for them?

High-Touch Client Service Professionals

Client service is a critical component to any business relationship, especially when your end-clients expect direct access to the individuals delivering the service. When outsourcing bill payment functions to a dedicated personal expense management team, your clients gain access to a group of service professionals operating as a direct extension of your own team.

More importantly, your clients will have the opportunity to interact with individuals who are exclusively focused on the nuances of their expense trends, bill payment requirements and reporting expectations, allowing your own internal teams to concentrate on the strategic, relationship-building discussions and action items.

Turnkey Digital Engagement Tools

Over-the-phone approvals and checks signed by hand are functional, but is there a more efficient alternative? We believe so.

At Archway Family Office Services we’ve built proprietary, cutting-edge technology that automates and digitizes historically manual accounts payable functions. As a result, our personal expense management service includes access to a customizable workflow tool that notifies you and your end-clients when a bill is pending approval, and allows you to quickly and easily submit digital approvals through a secure client portal with the click of a button.

This ultimately translates to a modern, technology-based client experience that doesn’t require technical resources on your end.

Secure, Trusted Operational Processes

As with any type of outsourced service, your third-party partner needs to be dependable and proven. This has become more relevant than ever in the wake of COVID-19 and the remote work environment that followed.

At Archway Family Office Services, we put oversight and security at the forefront of our solutions. Featuring dedicated P.O. boxes, trained staff and a time-tested technology infrastructure, your clients will benefit from decades of bank-grade security assessments, product development and process refinement, taking the onus off of your firm to check these boxes.

Bespoke Cash Flow and Expense Reporting

Most bill payment services can guarantee that your client’s bills will be paid correctly and on time. However, we recommend looking for service organizations that go beyond issuing payments and reconciling transactions—organizations that provide meaningful insights into your client’s bill payment and expense data.

Through our personal expense management service, Archway Family Office Services offers online interactive dashboards and easy-to-access reporting that depicts spending habits, credit card activity, cash flow, payment details and vendor records so that you and your clients have full transparency into the inflows and outflows of their accounts.

Having this level of detail accessible at their fingertips ultimately puts your clients in total control of their spending and empowers you to have well-informed conversations about their complete financial picture.

While outsourcing your firm’s bill payment and expense reporting operations provides a degree of continuity, some firms prefer to manage these processes in-house.

Today, hundreds of family offices, CPA firms and private banks are using family office accounting software solutions like the Archway PlatformSM to deliver a superior personal expense management experience to their clients. Through the platform’s purpose-built tools, users are able to store digital invoices, track bills, reconcile bank accounts, manage workflow, cut checks and deliver comprehensive expense and cash flow reporting.

And for those who are somewhere in the middle, our flexible suite of accounts payable technology and outsourced services enable us to offer a hybrid model that allows clients to manage key functions of the bill payment process while leveraging Archway resources to manage time-consuming, repetitive tasks like collecting invoices and entering bills.

Regardless of your operational preferences, Archway Family Office Services can tailor a personal expense management offering that is unique to your firm, your processes and your clients.

Learn more about our award-winning Personal Expense Management service and how Archway Family Office Services can help you offer a world-class bill payment and cash flow reporting solution to your sophisticated high-net-worth clients.

|

|

Steven Edelman

|

Author

Steven Edelman

Managing Director, Institutional Relationships

Archway Family Office Services

Most Popular Posts

May 24, 2022

6 Ways to Build a Net Worth Report for Your Family Office Clients

Eric Sampson

How Family Offices Can Prepare a Holistic View of High-Net-Worth Client Wealth

May 17, 2019

Financial Reporting for the Modern Family Office

Steven Edelman

10 Types of Reports Every Family Office and Financial Institution Should Have in Their Toolkit

Apr 20, 2022

What Types of Software Do Family Offices Use?

Archway Family Office Services