6 Ways to Build a Net Worth Report for Your Family Office Clients

May 24, 2022

How Family Offices Can Prepare a Holistic View of High-Net-Worth Client Wealth

How often have you been asked by your client, “How much am I worth?”

And when you’re asked, how much time does your family office spend stitching together the financial information needed to give an answer? Better yet, are you even able to answer the question with confidence at all?

Although it’s a simple enough request, an accurate answer can be incredibly nuanced—especially if the required data resides across systems, spreadsheets, and statements.

To that end, it should come as no surprise that comprehensive net worth reporting is one of the most sought after capabilities among family offices and their end-clients during the family office software evaluation process.

While the fabric of these reports can vary greatly, we’ve compiled a list of six ways family offices can illustrate client net worth.

By activity

Show how your client’s net worth has changed across a period by using beginning and ending market values based on purchases, transfers, gains/losses, dividends, interest, fees, and other cash flows like contributions/withdrawals, private equity distributions, or fund redemptions.

By entity ownership

Display net worth based on your client’s direct and indirect exposure to various legal entities within the family office, including their personal accounts, trusts, and holding companies as well as multi-ownership vehicles like family limited partnerships and private funds.

By holdings

Provide net worth detail across individual assets, such as securities, commodities, private equity investments, hedge fund subscriptions, cryptocurrency, bonds, mutual fund shares, real estate, land/property, oil/mineral tracts, collectibles, and other personal assets.

By asset allocation

Summarize a client’s net worth for quick analysis using common categories, like asset type or sector, to group holdings—or use more specialized groupings, like Sustainable Development Goals, ESG ratings, or investment risk.

By portfolio allocation

Break down net worth by specific portfolios, which can include bank, custodial or brokerage accounts, alternative investment portfolios and personal assets, or group portfolios together by account type, strategy or manager to help build context for additional types of reports like performance and attribution reporting.

By region

Show clients the geographic spread of their net worth across continents, regions and countries to create a better gauge of risk due to environmental, social, and governance influences.

Start building unique net worth reports for your clients.

Archway’s Archway PlatformSM is leveraged by hundreds of family offices and advisors to wealthy families to deliver comprehensive net worth reporting. Over the course of 20 years, we have built out the platform’s report library to include a wide array of reports ranging from traditional financial statements to asset allocation, activity, holdings, performance, risk, and alternative asset-specific reporting.

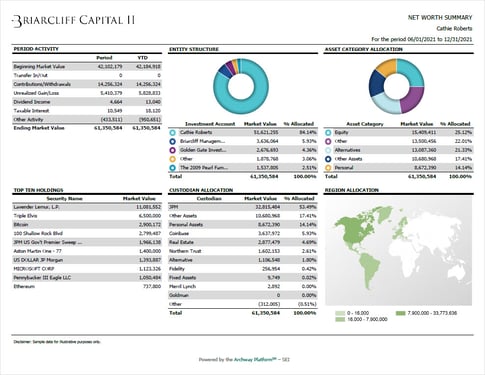

For example, family office staff can quickly and efficiently prepare a Net Worth Summary report, pictured below, using one of 200+ standard reports that are available to Archway Platform users through the application’s reporting tools.

Users can customize the dashboard-style report to incorporate up to six data inserts, from activity, portfolio breakdown and overall performance to asset allocation, geographic exposure and ownership distribution.

To learn more about the Archway Platform’s reporting capabilities, schedule a call with a member of our team for a personalized tour of the application and its full suite of reports.

|

|

Eric Sampson

|

Author

Eric Sampson

Relationship Manager

Archway Family Office Services

Most Popular Posts

May 24, 2022

6 Ways to Build a Net Worth Report for Your Family Office Clients

Eric Sampson

How Family Offices Can Prepare a Holistic View of High-Net-Worth Client Wealth

May 17, 2019

Financial Reporting for the Modern Family Office

Steven Edelman

10 Types of Reports Every Family Office and Financial Institution Should Have in Their Toolkit

Apr 20, 2022

What Types of Software Do Family Offices Use?

Archway Family Office Services